Apple today

announced financial results for the second fiscal quarter of 2025, which corresponds to the first calendar quarter of the year.

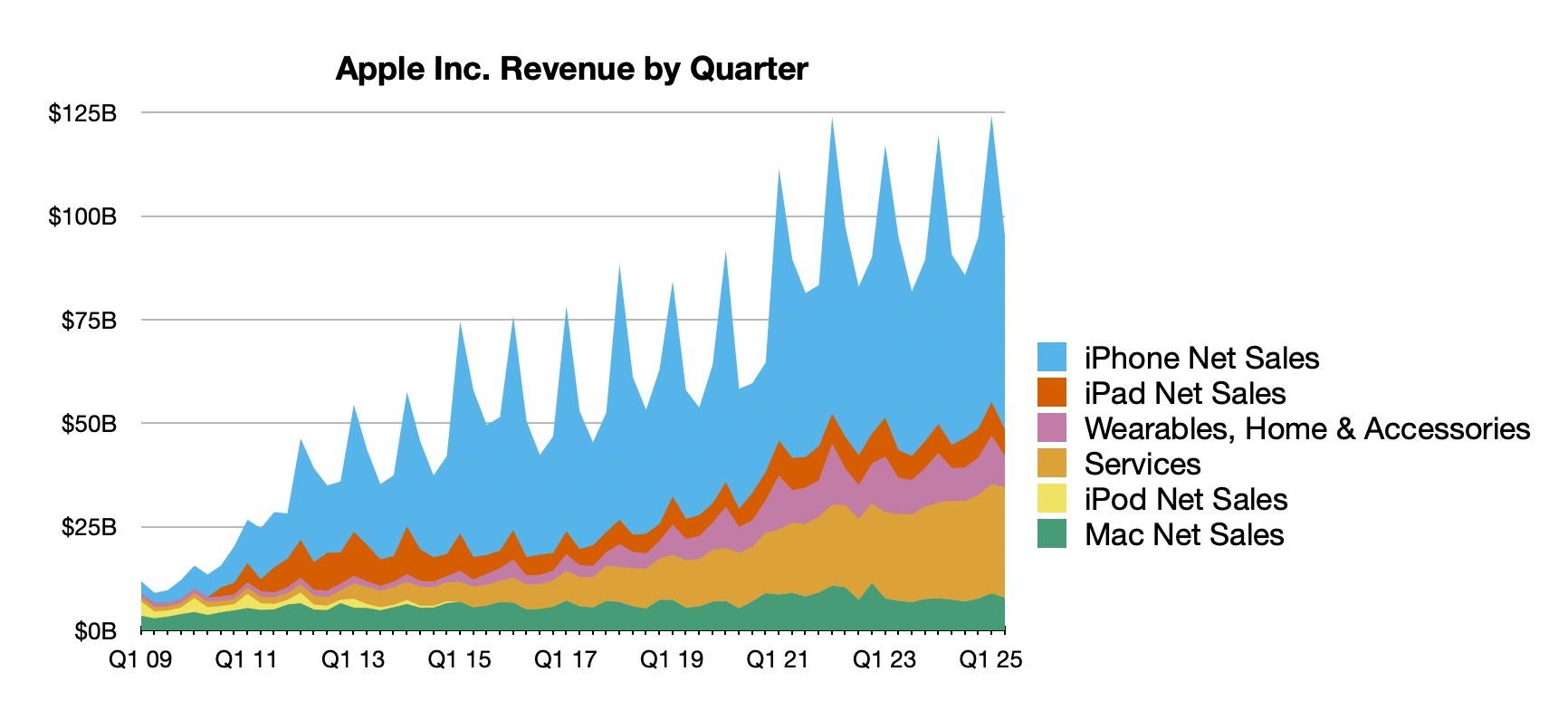

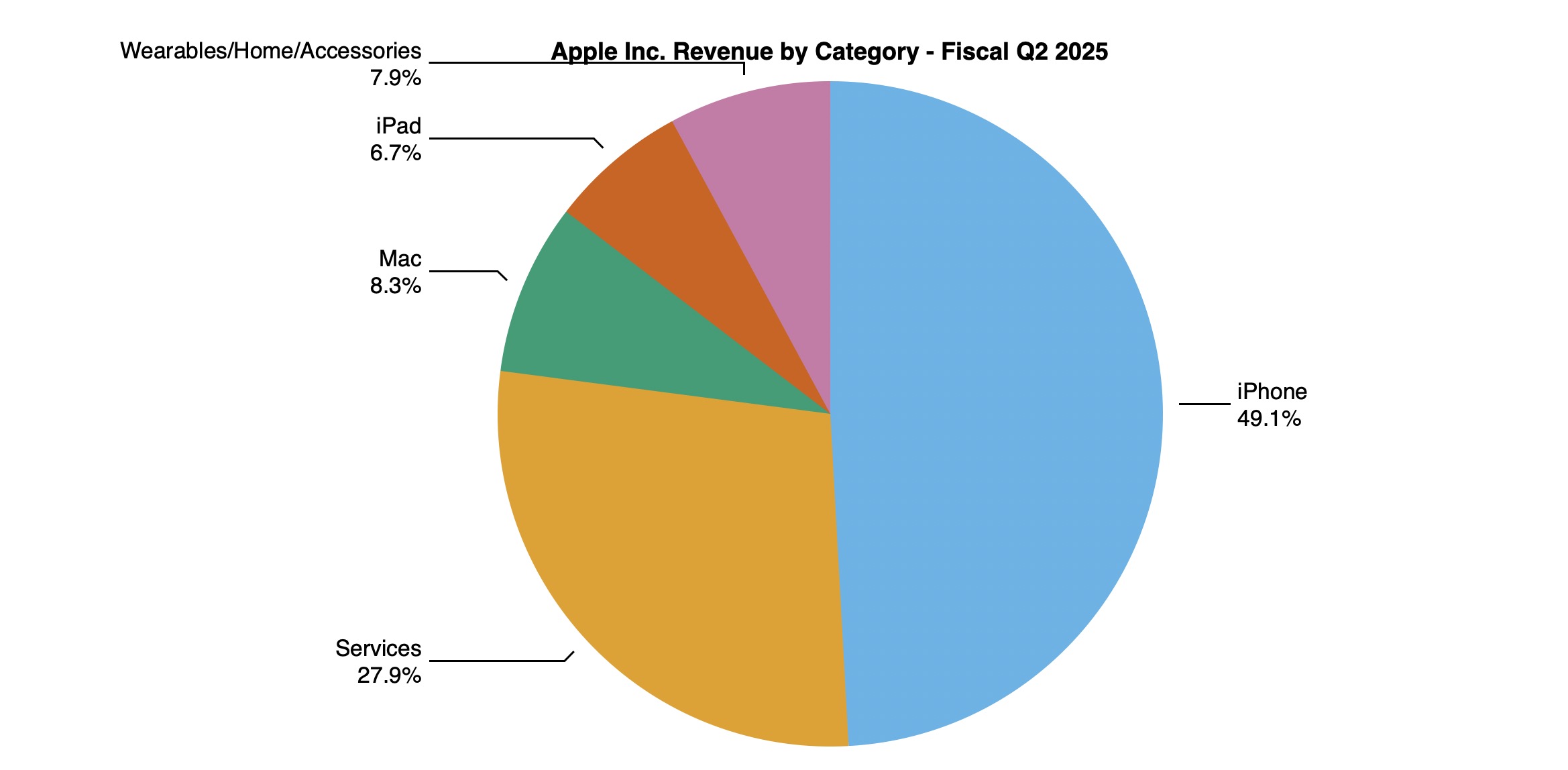

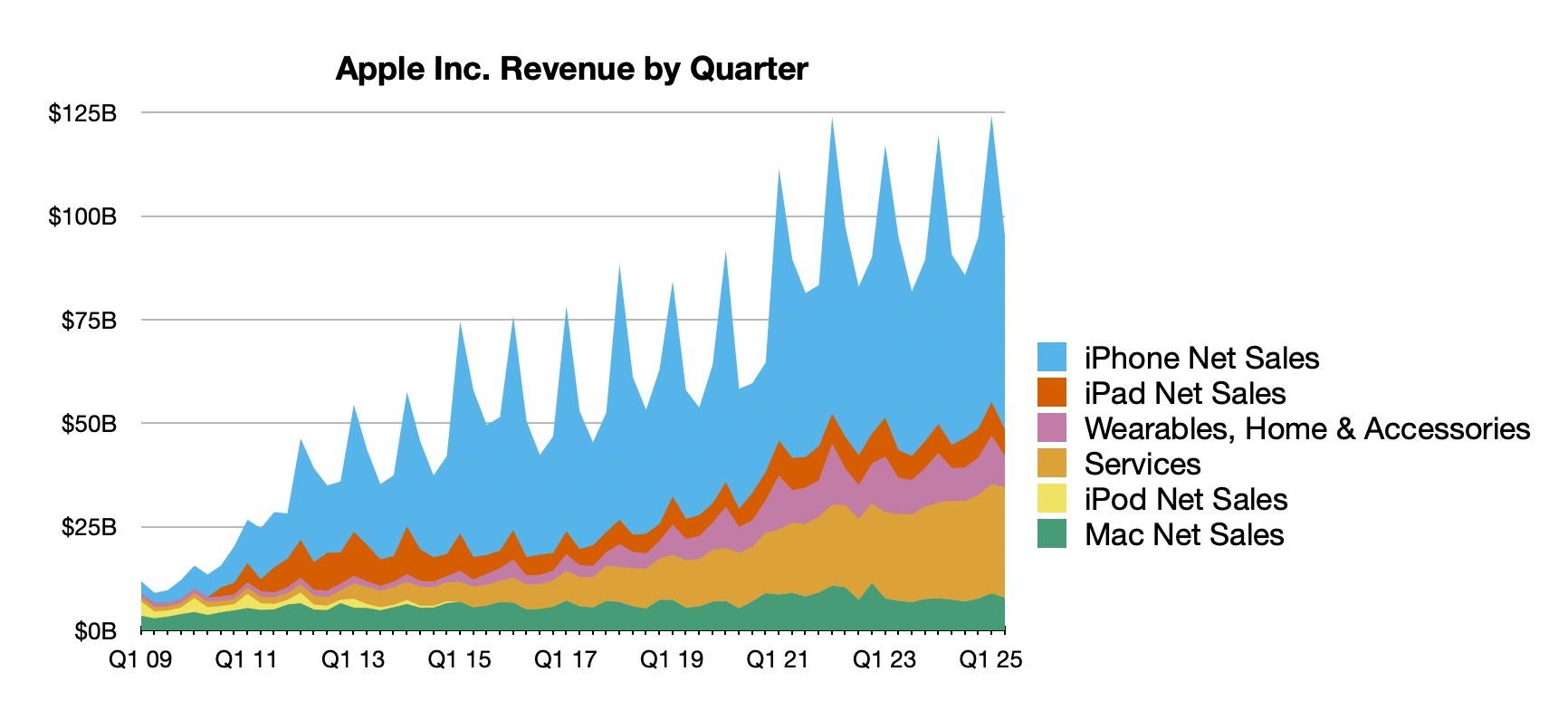

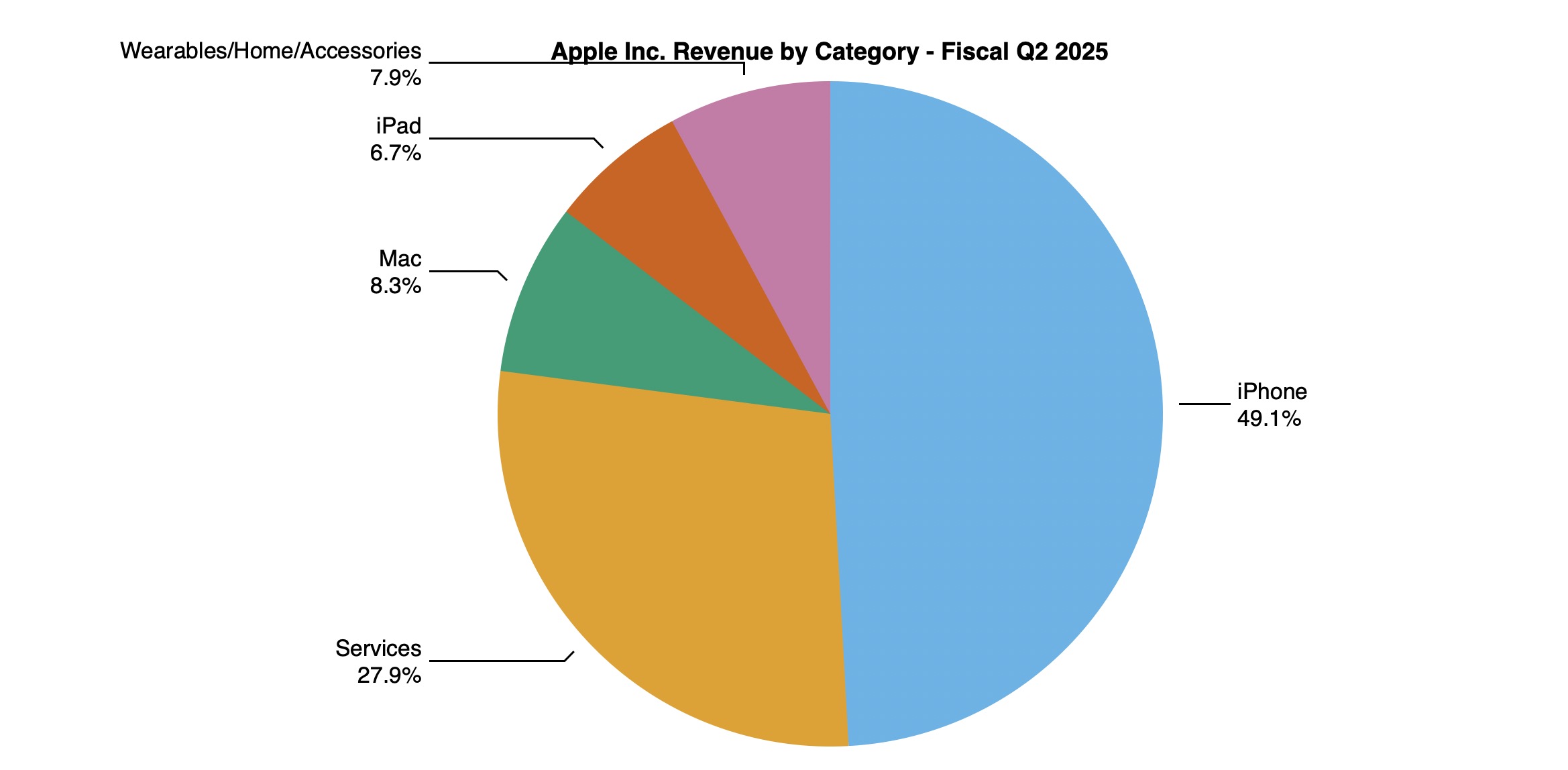

For the quarter, Apple posted revenue of $95.4 billion and net quarterly profit of $24.8 billion, or $1.65 per diluted share, compared to revenue of $90.8 billion and net quarterly profit of $23.6 billion, or $1.53 per diluted share, in the

year-ago quarter. Services revenue reached an all-time high during the quarter, while earnings per share set a March quarter record.

Gross margin for the quarter was 47.1 percent, compared to 46.6 percent in the year-ago quarter. Apple's board of directors also authorized an additional $100 billion for share repurchases and declared an increased dividend payment of $0.26 per share, up from $0.25 per share. The dividend is payable May 15 to shareholders of record as of May 12.

"Today Apple is reporting strong quarterly results, including double-digit growth in Services," said Tim Cook, Apple's CEO. "We were happy to welcome iPhone 16e to our lineup, and to introduce powerful new Macs and iPads that take advantage of the extraordinary capabilities of Apple silicon. And we were proud to announce that we've cut our carbon emissions by 60 percent over the past decade."

As has been the case for over five years now, Apple is once again not issuing guidance for the current quarter ending in June.

Apple will

provide live streaming of its fiscal Q2 2025 financial results conference call at 2:00 pm Pacific, and

MacRumors will update this story with coverage of the conference call highlights.

Conference call recap ahead...

1:37 pm: "Our March quarter business performance drove EPS growth of 8 percent and $24 billion in operating cash flow, allowing us to return $29 billion to shareholders," said Kevan Parekh, Apple's CFO. "And thanks to our high levels of customer loyalty and satisfaction, our installed base of active devices once again reached a new all-time high across all product categories and geographic segments."

1:38 pm: Apple's share price is down around 2.5% in after-hours trading following the earnings release, after rising about 0.4% in regular trading earlier today.

1:41 pm:

iPad revenue was up 15.2% year-over-year while Services revenue was up 11.6%, Mac revenue was up 6.7%, and

iPhone revenue was up 1.9%. Wearables, Home, and Accessories was the only product category to see a year-over-year revenue decline, dropping 4.9%.

1:44 pm: On a geographic basis, Japan led the way in revenue increase at 16.5% year-over-year, the rest of Asia Pacific excluding Greater China saw an 8.4% increase, the Americas saw an 8.2% increase, and Europe saw a 1.4% increase. Greater China was the only geographic segment to see a decline at –2.3%.

2:00 pm: Apple's earnings call should be begining momentarily. On the call should be Apple CEO

Tim Cook and CFO Kevan Parekh.

2:01 pm: The call is opening with an introduction from Suhasini Chandramouli, Apple's head of investor relations, giving the standard notices about forward-looking statements.

2:02 pm: Tim is taking over for introductory remarks.

2:03 pm: "We are reporting $95.4 billion in revenue, up 5% from a year ago and at the high end of the range we provided last quarter. Diluted earnings per share were $1.65, up 8% year over year and a March quarter record. Services achieved an all-time revenue record, growing 12% over the prior year. Quarterly records were also set in the UK, Spain, Finland, Brazil, Chile, Turkey, Poland, India and the Philippines.

2:04 pm: He is also touting the impact Apple is making in the United States, including plans to spend $500 billion over the next four years and expanding facilities in a number of states. A new factory for advanced server manufacturing in Texas will open later this year.

2:05 pm: iPhone revenue was $46.8 billion, up 2% year over year. During the quarter,

iPhone 16e was launched, including Apple's newest in-house designed modem.

iPhone 16 and 16 Pro "continue to be a hit with our users."

2:06 pm: Mac revenue was $7.9 billion, up 7% year over year. New updates during the quarter included M4

MacBook Air.

Mac Studio is "the most powerful Mac we've ever shipped."

2:06 pm: For iPad, revenue was $6.4 billion, up 15% from a year ago. iPad lineup "continues to help users learn, work, play and go wherever their imaginations take them. The new

iPad Air with M3 combines powerful performance and exceptional portability." Tim is touting

Apple Intelligence across all the devices.

2:08 pm: Wearables, Home and Accessories revenue was $7.5 billion, down 5% from a year ago. Apple Watch Series 10 and

AirPods 4 with Active Noise Cancellation, as well as

AirPods Pro 2 with the new hearing health features are some of the flagship items of the category, with

Apple Vision Pro getting a shoutout as well, with that product now a year old.

2:08 pm: Two retail stores were opened in the quarter, with a new store in the UAE and India coming during this quarter, plus the online store in Saudi Arabia.

2:08 pm: Services reached an all-time revenue record of $26.6 billion, up 12% and reflecting strong performance across all categories.

2:09 pm:

Apple TV+ set a record for viewership in the quarter, and the new F1 movie starring Brad Pitt hits theaters this summer. Apple TV+ has earned more than 2,500 award nominations and 560 wins.

2:10 pm: He mentions sports with Friday Night Baseball, MLS Season Pass and Formula 1 on the Apple Sports app.

2:10 pm: iOS 18.4 brings Apple Intelligence to more languages including French, German, Italian, Portuguese, Spanish, Japanese, Korean and Simplified Chinese, as well as localized English in Singapore and India.

2:11 pm: "AI and machine learning are core to so many profound features we've rolled out over the years to help our users live a better day. It's why we designed Apple silicon with a neural engine that powers so many AI features across our products and third-party apps. It's also what makes Apple products the best devices for generative AI."

2:12 pm: He's touting Apple Intelligence extensively, but he's also noting that the "more personal

Siri features" need more time to complete "so they meet our high quality bar. We are making progress and we look forward to getting these features into customers' hands."

2:12 pm: Apple continues to make progress on achieving carbon neutrality across the supply chain.

2:13 pm: Now he's addressing tariffs. "We had a limited impact in the March quarter, due to optimizations of our supply chain and inventory."

2:14 pm: For the June quarter, currently, we are not able to precisely estimate the impact of tariffs, as we are uncertain of potential future actions prior to the end of the quarter.

However, for some color, assuming the current global tariff rates, policies, and applications do not change for the balance of the quarter, and no new tariffs are added, we estimate the impact to add $900 million to our costs. This estimate should not be used to make projections for future quarters, as there are certain unique factors that benefit the June quarter.

2:14 pm: "As we look ahead, we remain confident, confident that we will continue to build the world's best products and services, confident in our ability to innovate and enrich our users' lives, and confident that we can continue to run our business in a way that has always set Apple apart."

2:15 pm: CFO Kevan Parekh is taking over, noting that there was a headwind of 2.5 percentage points from FX challenges, growing in the majority of markets.

2:16 pm: Gross margin was 47.1%, up 20 basis points sequentially, primarily driven by favorable mix. Product gross margin was 35.9%, while services gross margin was 75.7%.

2:16 pm: Net income was $24.8 billion, diluted earnings per share was $1.64, up 8% year over year and a March quarter record.

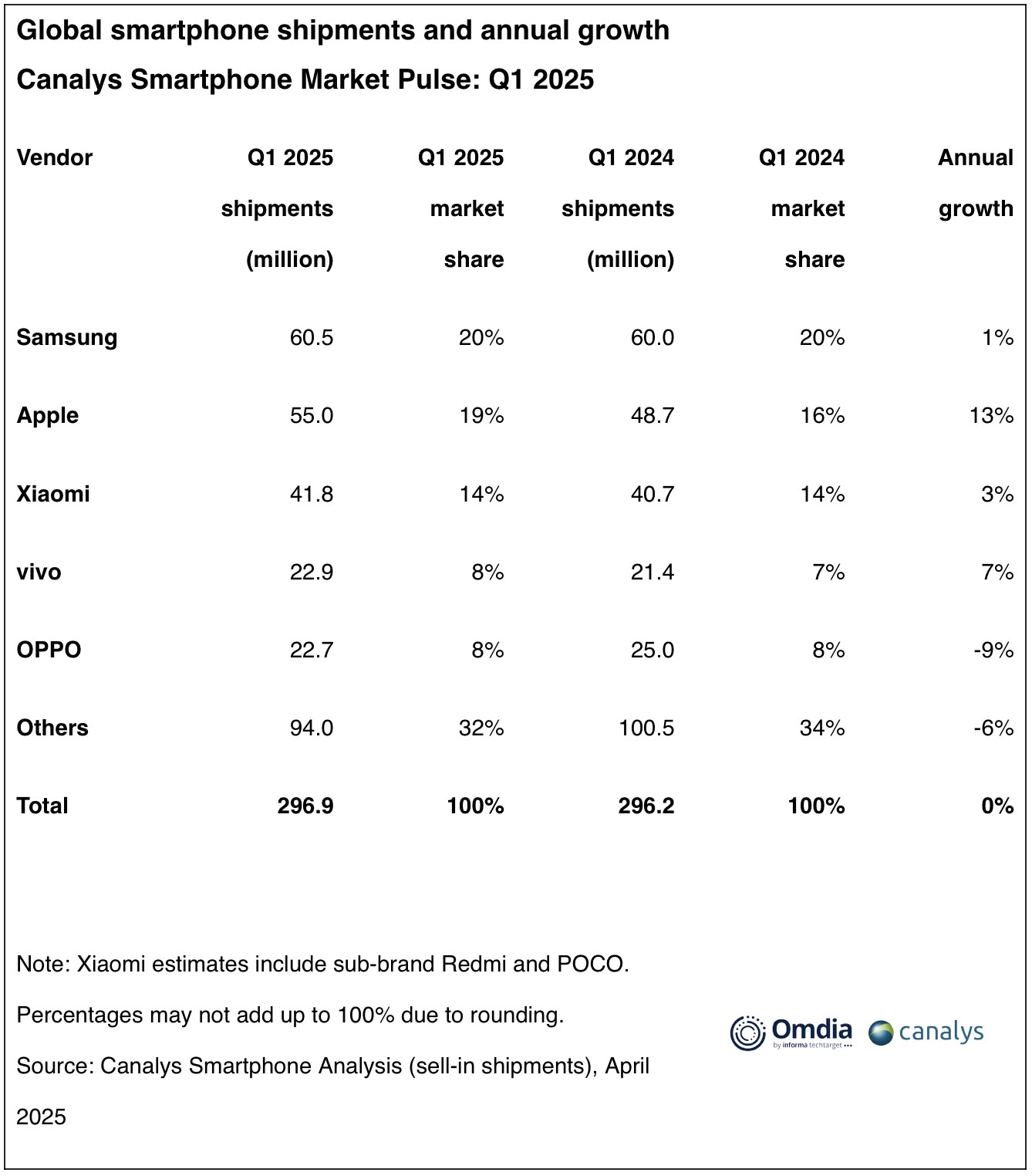

2:17 pm: iPhone active install base grew to an all-time high in total and across every geographic segment. iPhone was the top-selling model in the US, urban China, UK, Germany, Australia and Japan. 97% customer satisfaction.

2:17 pm: Mac revenue was $7.9 billion, up 7% year over year, with every geographic segment growing year over year. Mac install base grew to an all-time high, with growth for both upgraders and customers new to the Mac. Customer satisfaction was 95% in the US.

2:17 pm: iPad revenue was $6.4 billion, up 15% year over year, with a new all-time high in user base and more than half of customers purchasing an iPad new to the product. Customer satisfaction was 97% in the US.

2:18 pm: Wearables, Home and Accessories revenue was $7.5 billion, down 5%, against a difficult compare last year with the launch of the Apple Vision Pro and

Apple Watch Ultra 2.

2:19 pm: Services revenue was $26.6 billion, up 12% year over year, comparable to the December quarter's growth rate when negative impact from FX is removed. Paid accounts grew double digits year over year, as did paid subscriptions. More than 1 billion total paid subscriptions.

2:19 pm:

Apple Pay active users reached an all-time record, up double digits year over year.

2:20 pm: In the enterprise, KPMG rolled out iPhone 16 for all US employees. Strong Mac performance in enterprise. MacBook Air is standard computer for Nubank's thousands of employees.

2:21 pm: Regarding cash position, Apple ended the quarter with $133 billion in cash and marketable securities. $98 billion in total debt, with a net cash position of $35 billion. Returned $29 billion to shareholders, including $3.8 billion in dividends and equivalents, and $25 billion through open market repurchases of 108 million Apple shares. $100 billion in share repurchases have been authorized, with dividend increasing to 4% to 26 cents per share, with plans for annual increases in the dividend going forward.

2:22 pm: The color provided assumes that global tariff rates remain in effect as of this call, and that the global macro outlook doesn't worsen from today. Color at the total company level is still being provided. June quarter will grow low to mid single digits year over year. Gross margin between 45.5% and 46.5%, which includes estimated $900 million in tariff-related costs. OpEx to be between $15.3 and $15.5 billion. Tax rate around 16%.

2:22 pm: The Q&A session with analysts is beginning.

2:26 pm: Q: Re iPhone sourcing, you said 50% of US iPhones are currently sourced from India. Is your goal to expand that to 100%? How should we expect that to trend?

A: The existing tariffs that apply to Apple are based on the product's country of origin. For the June quarter, we expect the majority of iPhones sold in the US will have India as their country of origin, and Vietnam to be the country of origin for almost all iPad, Mac, Apple Watch and AirPods sold in the US. China would continue to be the country of origin for the vast majority of total product sales outside the US.

For the June quarter, most of the tariffs that apply to us, relate to the February IEEPA related tariffs at 20%, for imports to the US of products with China as their country of origin. For 120% tariff, that covers certain categories including

AppleCare and some accessories. That brings the total rate in China for those products to 145%.

The vast majority of our products including iPhone, Mac, iPad, Apple Watch and Vision Pro, are currently not subject to the global reciprocal tariffs from April. The Commerce Department has initiated a Section 232 investigation into imports of semiconductors and semiconductor manufacturing equipment and downstream products that contain semiconductors.

For June, we estimate the impact, assuming that the current global tariff rates, policies and applications don't change, to be $900 million. I don't want to predict the mix of production, but wanted to give you clarity for the June quarter on country of origin so you can use that for your modeling.

2:27 pm: Q: There were reports that Apple had pulled forward sales into the channel to get ahead of tariffs. Were sell-in and sell-through in the March quarter? Should they be aligned in the March quarter, and do you see any acceleration in hardware purchases or was behavior normal?

A: In terms of pull-forward in demand, if you look at the March quarter, we don't believe that we saw obvious evidence of a significant pull forward in demand in March due to tariffs. If you look at channel inventory from the beginning of the quarter to the end, unit channel inventory was similar, not only for iPhone but for the balance of our products. You will see that we did build ahead inventory and that's reflected in manufacturing purchase obligations that you'll see on the quarterly filing. I hope that answers all your questions.

2:29 pm: Q: If you'd told me on April 2 that your impact of tariffs was only $900 million, that'd be a pretty good outcome given the panic that ensued. I'm surprised it's that low, and I know that you gave a comment about the impact after the June quarter — can you give us an idea, is that a multiple? Can you give any guidance on if it's bigger or smaller or what.

A: I tried to give some information on country of origin which is currently the key factor in determining the tariffs that we're paying. I don't want to predict the future because I'm not sure what will happen with the tariffs, and there is this Section 232 investigation going on. June has the assumptions in it that I mentioned earlier.

2:32 pm: Q: With regards to China down 2%, you intuitively would have thought that there would have been an increased nationalism and perhaps it would have been worse than that. The trajectory there improving with subsidies benefited your competitors too. Can it keep improving given the geopolitical tensions?

A: Down 2% in the March quarter, we were roughly flat when you remove headwinds from foreign exchange. Channel inventory at the end of March was similar to where we started the quarter. The subsidies played a favorable impact on the results, it's difficult to estimate the precision as to how much but I think it was positive. Some products are included, some are not. Generally on iPhone, if something is priced above 6,000 RMB, it's not eligible and other products have different rules. I do think it helped, and it's helping others as well I'm sure.

iPhone was the key driver of the improvement sequentially. Hopefully that provides some color. The Mac, iPad and Watch are attracting a majority of customers new to that product. That continues to look quite good in China and iPhone was the top two models in urban China, and iPad was the top two tablets in urban China. Some positive nuggets there.

2:33 pm: Q: Appreciated the transparency around building ahead with inventory, will you continue to do that until we get clarity on the Section 232 investigation, and what's your philosophy on pricing and elevated costs that come through, whether to resellers or end consumers?

A: We are engaged on tariff discussions. We believe in engagement and we will continue to engage. On pricing, we have nothing to announce today, and the operational team has done an incredible job around optimizing the supply chain and the inventory, and we'll continue to do those things to the degree that we can.

2:34 pm: Q: On product gross margin, can you provide some color on factors that might have impacted product GM in the quarter, down sequentially on seasonal factors, but year over year decline as well. Any additional color would be helpful.

A: On sequential, we had decrease by 340 basis points sequentially driven by mix, seasonal loss of leverage, and foreign exchange, partially offset by cost savings. Year over year, down 70 BP, driven by a different mix and FX.

2:35 pm: Q: Talked about $900 million hit to product sales, what are the benefits to the June quarter and what would the impact be without them?

A: Wouldn't want to go through all of them, but the build-ahead in the manufacturing purchase obligations were helpful.

2:36 pm: Q: Do you expect Services growth to remain in the double digit range thorugh the back half of the year and how does Services stack up in the June quarter?

A: Low to mid single-digit improvement year over year, with FX to improve sequentially, but a slight headwind to revenue year over year, but we aren't providing category-levels of color today.

2:39 pm: Q: How should investors think about the gross margin trajectory as you source more from the US or other supply chain changes, including in India, how should those go into the cost structure?

A: We're excited about bringing more production to the US, as you know we've been very key in the TSMC project in Arizona and are the largest and first customer getting product out of that. That's the SoC that's coming out of there. We also have glass coming out of the US and the

Face ID module. And loads of chips, some 19 billion coming out across 12 states, down to the resistor and capacitor level. Some of that is already built into the margins that Kevan has quoted and we don't forecast beyond the current quarter.

Re margin going forward, every product cycle is different. We've managed gross margin well, we've made good decisions. As we launch new products, they tend to have a higher cost structure than the products they replace. As we introduce new features and technologies, we have a track record of reducing cost structures over the life of the product.

2:40 pm: Q: Could you share color around what you have seen in developer behavior in Europe where there has been emergency of alternate app stores for a little more time, anecdotally or in your data, in terms of dev behavior large or small? Any color on what has actually happened?

A: It's embedded in our results. Embedded in the overall company color that was provided. As you know, the digital markets act went into effect in March of last year, so the DMA has been enacted for a bit over a year and there's been alternate app stores for some period of time of that. At this point, in Europe, it's embedded in the actuals. There may be more to come and so forth, but I don't want to predict beyond the current quarter.

2:43 pm: Q: Can you update us on your thoughts about your resiliency and redundancy following the changes you've talked about on the supply chain? Where's the supply chain 2-3 years from now and is there risk of export control issues? You quantified a $900 million hit from tariffs, but is there a hit from how you're thinking about demand backdrop holistically?

A: In terms of resiliency and risk, we have a complex supply chain, there's always risk in the supply chain and I wouldn't tell you anything different from that. What we learned some time ago, having everything in one location had too much risk with it. We have, over time, with certain parts of the supply chain, opened up new sources of supply. You could see that kind of thing continuing in the future.

Our best thinking is captured in the outlook we've provided. But the assumptions we made, assume that the global tariff rates and policies remain the same, and that the global macro outlook doesn't worsen from today.

Q: No quantifiable impact on demand to date, where we are over the last month?

A: Our best thinking is reflected in the range we provided.

2:44 pm: Q: You made a comment on Apple Intelligence making an impact on iPhone sales in the countries where it was available. Has that continued to play out in the broader number of countries as you've rolled that out?

A: During the March quarter, we saw year over year performance in countries with Apple Intelligence, it was stronger than those countries where Apple Intelligence was not available. Many of the upgrades you're referring to rolled out in April, which is Q3.

2:45 pm: Q: You've had opinions of consumers reacting to overall macro, and prefaced your guidance with macro remaining consistent... what's the reaction in how consumers are reacting to the macro at this point?

A: I'm not an economist so I start by saying that. From a total company point of view, our results accelerated sequentially to the 5% level and the US is the vast majority of the Americas segment and you can see how the Americas performed during the quarter. I don't want to try to predict what happens in the months from now but I'm quite pleased with the results from Q2.

2:47 pm: Q: How should we think about how much CapEx is in R&D, how much is in TSMC, Texas server, any color on the $500 billion in investment?

A: There's lots in all of it, but we're not giving out the exact split. As we expand facilities in different states, Michigan, Texas, California, Arizona, Nevada, Iowa, Oregon, North Carolina, Washington, there will be CapEx and OpEx involved in all of it. Standing up our server manufacturing in Texas will be through a partner, as we do with manufacturing, putting a fair amount in cost of goods sold to do that, some OpEx, some CapEx, so it's a bit of all of it.

2:48 pm: Q: A longer term philosophical question, you've spoken about AI on the edge, from iPhone and Mac angle, looking at AI on the edge, are the current smartphone and silicon specs good enough to reach LLM inference, how should we think about the evolution of edge devices here?

A: As you know, we're shipping an LLM on the iPhone 16 today. There are some of the queries used by our customers are on-device, and others are going to the private cloud where we mimic the security and privacy in the device into the cloud. Others, for world knowledge, use the integration with ChatGPT. We continue to be very excited about the opportunities here, we're very excited about the roadmap, and we are pleased with the progress that we're making.

2:51 pm: Q: I won't ask about tariffs. Given that you said new Siri is taking longer than you thought to deliver, what are some of the learnings you had from those delays, are they related to legacy software stack, organizational factors, or a matter of R&D spending? What are factors investors should look for at WWDC or beyond that Apple can deliver on the promises that it's made?

A: At WWDC, we've talked about a number of different features that would launch with

iOS 18, we've released a slew of those from writing tools to seamlessly connecting to ChatGPT to image playground, image wand, visual intelligence, making movies of your memories with a prompt, AI-powered photo search, smart replies, priority notifications, the list goes on. Recently, we expanded it into different languages including French, German, Italian, Portuguese, Spanish, Japanese, Korean, Simplified Chinese... but with regard to more personal Siri, we just need more time to complete the work so it meets our quality bar. There's not a lot of other reason for it, it's just taking a bit longer than we thought. We are making progress and are extremely excited to get the more personal features out there.

We make significant investments in our R&D, and we are making all the investments we think we need to enable our roadmap.

2:52 pm: Q: Hard to ignore some of the very high profile legal cases that touch on Apple, Google antitrust, Epic injunction, do you have ample ways to mitigate some of the negative impacts on Apple Services business that might come about in legal rather than commercial pressures?

A: The case yesterday, we strongly disagree with it. We've complied with the court's order and we're going to appeal. In the Google case, that's ongoing so I don't have anything to add. But as you point out, there is risk associated with them and the outcome is unclear.

2:55 pm: Q: I want to go back to the AI strategy a little bit. You talked about building your own foundational models, how important do you think it is for Apple to have its own models and dovetailed with that, how do you think about your data center footprint with Apple spending $3 billion a quarter relative to companies spending multiples of that? How does the strategy play out in your opinion?

A: On the data center side, we have a hybrid strategy. We utilitize third parties in addition to the data center investments that we're making. As I mentioned, in the $500 billion, there's a number of states that we're expanding in, some of those are data center investments. We do plan on making investments in that area and we're not gating it. We invest in the business first. We want to have certain models and we'll partner as well, so I don't view it as an all of one or all of the other, what's on device or what's in the Private Cloud Compute.

2:56 pm: Q: With the iPhone 16 e, internalizing your C1 modem, how do you see that modem strategy playing out?

A: We're excited to ship the first one and get it out there, we love to ship better products from a point of view of focusing on battery life and other things customers want. We've just started on that journey is how I would put it.

2:56 pm: The call is concluded!

This article, "

Apple Reports 2Q 2025 Results: $24.8B Profit on $95.4B Revenue" first appeared on

MacRumors.comDiscuss this article in our forums

Note: MacRumors is an affiliate partner with Amazon. When you click a link and make a purchase, we may receive a small payment, which helps us keep the site running.

Note: MacRumors is an affiliate partner with Amazon. When you click a link and make a purchase, we may receive a small payment, which helps us keep the site running.

Note: MacRumors is an affiliate partner with some of these vendors. When you click a link and make a purchase, we may receive a small payment, which helps us keep the site running.

Note: MacRumors is an affiliate partner with some of these vendors. When you click a link and make a purchase, we may receive a small payment, which helps us keep the site running.